Should Baby Boomers Buy or Rent After Selling Their Houses?

Are you a baby boomer who’s lived in your current house for a long time and you’re ready for a change? If you’re thinking about selling your house, you have a lot to consider. Will you move to a different state or stay nearby? Is it time to downsize or do you want more space to accommodate your loved ones? But maybe the biggest consideration boils down to this – will you buy your next home or choose to rent instead?

That decision ultimately depends on your current situation and your future plans. Here are two important factors to help you decide what’s right for you.

Expect Rents to Keep Going Up

Rising Rent Costs

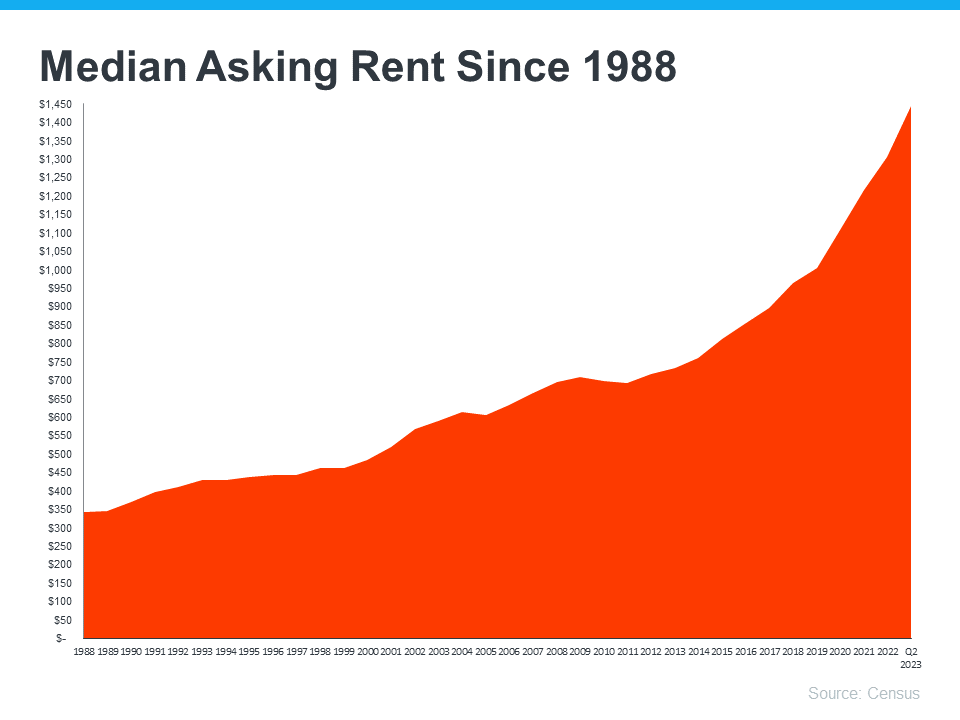

The graph below uses data from the Census to show how rents have been climbing steadily since 1988:

Rents have been going up consistently over the long run. If you choose to rent, there’s a risk your rental payment will go up each time you renew your lease. Having a higher rental expense may not be something you want to deal with every year.

Stability with Homeownership, What Baby Boomers Should Know

When you buy a home with a fixed-rate mortgage, it helps stabilize your monthly housing payment. This allows you to lock in your monthly payment for the duration of your home loan. That keeps your payments steady and predictable for the long haul. Freddie Mac sums it up like this:

“Homeowners with fixed-rate loans will see little to no change to their monthly housing cost over the life of their loan. You can be confident in knowing that your mortgage payments won’t change much in the long term, even when life’s other costs do.”

Owning Your Home Comes with Unique Benefits

Long-term Strategy

According to AARP, buying your next home is a better long-term strategy than renting:

“Though each option has pros and cons, buying provides more pros, with a broader range of benefits.”

Benefits of Homeownership

To help you choose what you’ll do after you sell, here are just a few of the benefits of homeownership:

Building Wealth: Owning your home can help you save money for the future. Your home, and the equity you build as a homeowner, can provide generational wealth that could be passed on to loved ones, giving them a better life.

No Monthly Mortgage Payment: You might not have to pay a monthly mortgage payment at all. If you have enough equity to buy your next home outright, you wouldn’t have a monthly mortgage payment. While you might still need to cover property taxes or maintenance fees, not having to worry about a monthly mortgage payment could be a big relief.

Freedom to Customize: Aging in place can be simpler. If your needs change, owning your home gives you the freedom to make renovations and updates that can make everyday life easier.

Conclusion

If you’re a baby boomer who’s wondering whether you should buy or rent your next home, let’s connect. With rents going up and homeownership providing so many benefits, it may make sense to consider buying your next home with experts guidance.

Frequently Asked Questions

1. How do I decide between buying and renting after selling my house?

The decision depends on your current situation and future plans. Consider factors like rising rent costs and the stability of homeownership.

2. Are rents expected to keep rising in the future?

Yes, rents have been consistently rising over the years, and there’s a risk of your rental payment increasing with each lease renewal.

3. What are some benefits of homeownership for baby boomers?

Owning a home can help you build wealth, eliminate monthly mortgage payments, and provide the freedom to customize your living space as your needs change.

4. Is buying a home a better long-term strategy than renting for baby boomers?

According to AARP, buying your next home is often considered a better long-term strategy due to the broader range of benefits it offers.

5. How can I ensure a stable housing payment in the long term?

Opting for a fixed-rate mortgage can help stabilize your monthly housing payment, ensuring it remains relatively unchanged over the life of your loan.