LEVERAGE YOUR HOME EQUITY TO NAVIGATE FINANCIAL HURDLES

Considering putting your home on the market? The prevailing mortgage rates might be giving you second thoughts. The hesitation of many homeowners is to venture into a new home with potentially higher mortgage rates. If you share these concerns, remember that while rates might be surging, so is home equity.. Dive in for more details.

Understanding Home Equity:

Simply put, residential equity reserves represents the part of your house that you truly own. It’s the gap between the property’s current value and the outstanding amount on your mortgage. As the value of your property escalates over time and as you chip away at the mortgage principal, your share of equity enlarges. Put differently, equity reflects your home’s present worth minus what’s pending on your mortgage, says Bankrate.

Snapshot of Current Home Equity:

Surprisingly, homeowners might find that their ownership value has expanded quicker than anticipated. CoreLogic provides a clearer picture, stating:

“The equity in a home, for the typical U.S. homeowner currently stands at around $290,000, says CoreLogic.” This swift growth is attributed to the marked rise in home prices in recent years. With the market slowly finding its equilibrium, the imbalance between demand (still high) and supply (still low) is nudging prices upwards.

What Does the Fed Say?

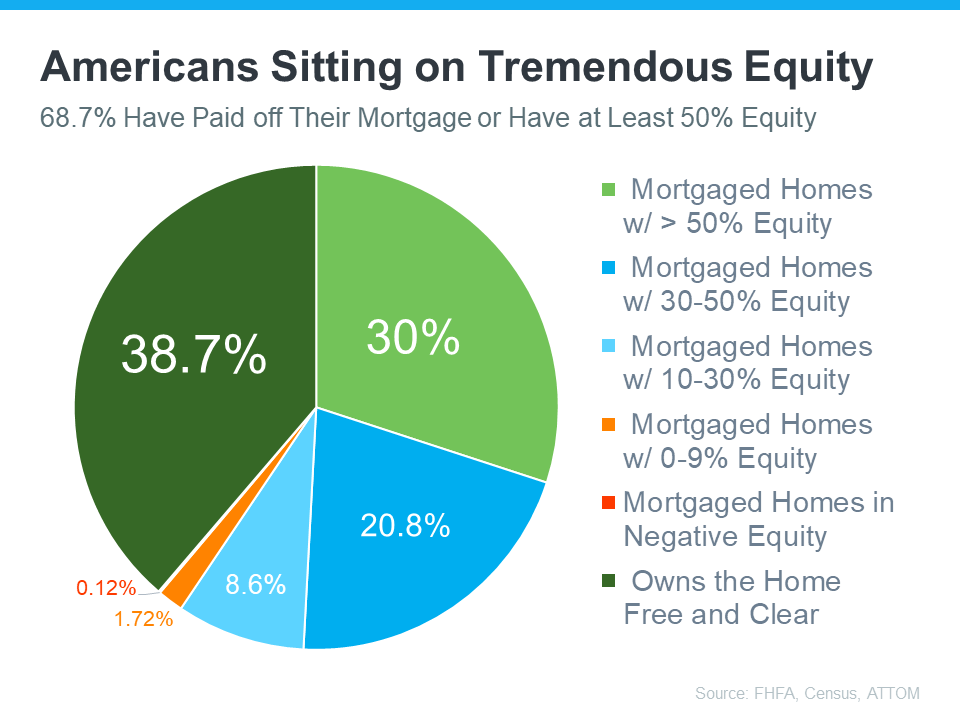

Recent data from the Federal Housing Finance Agency (FHFA), Census, and ATTOM suggests that nearly 68.7% of homeowners have either settled their mortgages in full or possess a minimum of 50% equity:

How Your Equity Addresses Affordability Issues:

In the current economic landscape, the equity you’ve accrued can play a pivotal role if you’re looking to relocate. After selling, the built-up equity in your home can bolster your next purchase:

- Go Cash-Only: If your tenure in your existing home spans several years, it’s plausible you have ample equity to secure a new property without seeking a loan. Thus, evading borrowing concerns and fluctuating mortgage rates. As the National Association of Realtors (NAR) aptly puts it, “Cash purchasers can steer clear of soaring mortgage interest rates.

- Opt for a Heftier Down Payment: Channel your equity towards a more substantial down payment on your subsequent home. This might significantly reduce the amount you need to borrow, making the prevailing rates less of a deterrent. Experian sheds light on this, stating, “A higher down payment diminishes your principal loan sum, potentially resulting in a more favorable interest rate from your financier.”

Key Takeaway: If relocating is on your mind, the equity cushion you’ve cultivated can be a game-changer in today’s context. To gauge your home’s current equity and harness it for your next property, let’s engage.

Frequently Asked Questions:

-

Defining Home Equity & Its Computation:

- Home equity is the monetary difference between your home’s market rate and the balance left on your mortgage. Derive it by deducting the mortgage balance from the home’s present value.

-

Strategies to Boost Home Equity:

- Amplify your home equity by reducing the mortgage principal, enhancing your property to augment its value, and capitalizing on property value spikes in your locality.

-

Alternate Uses of Your Properties’ Equity?:

- Absolutely, home equity can be channeled for diverse uses like home refurbishments, amalgamating debts, or unforeseen expenses. Always measure the advantages and disadvantages, and seek expert financial counsel before delving into your equity.

-

What Dictates My Equity?:

- Multiple elements impact your equity, including shifts in your property value, the consistency of your mortgage remittances, and any auxiliary financial obligations attached to your property.

-

Is Leveraging Your Equity to Acquire a New Property Prudent in a High-Interest Landscape?:

- Employing home equity for a new home acquisition can be strategic amidst elevated interest rates, as it sidesteps the need for a fresh, high-rate mortgage. Nevertheless, always review your financial health and collaborate with a mortgage specialist for a well-informed verdict.